OMX Stockholm PI (OMXSPI.ST)

Algorithmic Overall Analysis

Negative (Score: -79)

Apr 2, 2025. Updated daily.

Analyst's Recommendation

Weak Negative

Apr 1, 2025. 1 days ago.

Analyses

Short

Medium

Long

Overall

Insider

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Stock data

| Price date | Apr 2, 2025 |

| Currency | SEK |

| ISIN | SE0000744195 |

| Rise from year low | 1.93% |

| Fall from year high | -10.60% |

Automatic technical analysis. Short term

Short term

OMX Stockholm PI has broken the falling trend channel down in the short term, which indicates an even stronger falling rate. The index has marginally broken down through support at points 948. An established break predicts a further decline. The short term momentum of the index is strongly negative, with RSI below 30. This indicates increasing pessimism among investors and further decline for OMX Stockholm PI. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The index is overall assessed as technically negative for the short term.Recommendation one to six weeks: Negative (Score: -85)

Automatic technical analysis. Medium term

Medium term

An approximate horizontal trend channel in the medium long term is broken down. A continued weak development is indicated, and the index now meets resistance on possible reactions up towards the trend lines. It also gave a negative signal from the rectangle formation at the break down through the support at 960. Further fall to 874 or lower is signaled. The index has support at points 754 and resistance at points 1015. Volume tops and volume bottoms correspond well with tops and bottoms in the price. This weakens the trend break. The index is overall assessed as technically negative for the medium long term.Recommendation one to six months: Negative (Score: -77)

Automatic technical analysis. Long term

Long term

Investors have paid higher prices over time to buy OMX Stockholm PI and the index is in a rising trend channel in the long term. Rising trends indicate that the market experiences positive development and that buy interest among investors is increasing. The index gave a negative signal from the rectangle formation by the break down through the support at 960. Further fall to 874 or lower is signaled. The index has support at points 890 and resistance at points 1050. The index is overall assessed as technically neutral for the long term.Recommendation one to six quarters: Hold (Score: -24)

Full history

Candlesticks 95 days

Candlesticks 22 days

Insider Trades

Insider trades reported last 18 months. The stock is neutral on Insider Trades.

| List date | Trade date | Count | Price | Value | Text | Importance |

|---|

Commentaries

Automatic technical analysis of the stock, based on last closing price. The chart may have changed since the analyst's recommendation was written.

Analyst's Recommendation

Apr 1, 2025 (1 days ago)David Östblad

david.ostblad@investtech.com

David Östblad, Apr 1, 2025 (price 954.44)

Marknaden (Stockholmsbörsens breda OMSXPI-index) utvecklades positivt under tisdagen och det blev en uppgång på 0.98 procent. Indexet stängde på 954 punkter. Kursen till indexet bröt i och med måndagens nedgång ned genom stödet vid 960 punkter i en rektangelformation (REC). Det här utlöste en säljsignal och en fortsatt nedgång indikeras. Det blev även ett brott ned genom den horisontella trendkanalen och trendgolvet som har blivit identifierad på medellång sikt. Stöd återfinns vid 948-949 punkter på kort sikt och ser vi till det långsiktiga kursdiagrammet så finns det en stödnivå vid cirka 890 punkter. En etablering ovanför trendgolvet vid cirka 961 punkter och motståndet vid 966 punkter skulle neutralisera de senaste säljsignalerna något.Investtechs korta Hausseindex står idag i 35 på kort sikt. Indexet går mellan 0 och 100 och är en optimistindikator som visar andelen aktier på Stockholmsbörsen som haft köpsignal som sista signal. Ett värde mellan cirka 45-55 indikerar jämvikt mellan pessimister och optimister. På lång sikt står indexet i 44. Vi har därmed en övervikt av pessimister på kort- och lång sikt.

Investtechs insiderbarometer visar antalet köp- och säljtransaktioner som har genomförts av insynspersoner i börsens bolag. Den senaste månaden har det registrerats 544 köp och 171 försäljningar, vilket motsvarar en köpandel på 76 procent. Köpandelen på årsbasis är också 78 procent. Investtechs forskning visar att aktier starka på insiderhandel statistiskt överpresterar mot marknaden.

OMXSPI är samlat sett tekniskt svagt negativt på medellång sikt (1-6 månader). Närheten till stöd- och motståndsnivåer gör att den tekniska bilden snabbt kan komma förändras. Vi rekommenderar långsiktiga investerare att alltid vara investerade på marknaden.

Published: Morning Report (Apr 1, 2025 21:20) [DO]

Previous recommendations

David Östblad, Apr 1, 2025 (price 945.21)

Marknaden (Stockholmsbörsens breda OMSXPI-index) utvecklades negativt under måndagen och det blev en nedgång på hela 1.72 procent. Det var den fjärde dagen i rad indexet sjönk och den senaste veckan har indexet sjunkit 4.85 procent. Totalt gav mars som helhet en nedgång med 8.5 procent. Börsen stängde därmed på 945 punkter och indexet bröt med det botten från 13 januari i år och satte nytt årslägsta. Kursen till indexet bröt i och med måndagens nedgång ned genom stödet vid 960 punkter i en rektangelformation (REC). Det här utlöste en säljsignal och en fortsatt nedgång indikeras. Det blev även ett brott ned genom den horisontella trendkanalen och trendgolvet som har blivit identifierad på medellång sikt. På meddellång sikt återfinns ett stöd på 754 punkter men ser vi till det långsiktiga kursdiagrammet så finns det en stödnivå redan vid cirka 890 punkter. En etablering ovanför trendgolvet vid cirka 961 punkter skulle neutralisera de senaste säljsignalerna något.

Investtechs korta Hausseindex står idag i 34 på kort sikt. Indexet går mellan 0 och 100 och är en optimistindikator som visar andelen aktier på Stockholmsbörsen som haft köpsignal som sista signal. Ett värde mellan cirka 45-55 indikerar jämvikt mellan pessimister och optimister. På lång sikt står indexet i 44. Vi har därmed en övervikt av pessimister på kort sikt och lång sikt.

Investtechs insiderbarometer visar antalet köp- och säljtransaktioner som har genomförts av insynspersoner i börsens bolag. Den senaste månaden har det registrerats 544 köp och 171 försäljningar, vilket motsvarar en köpandel på 76 procent. Köpandelen på årsbasis är också 78 procent. Investtechs forskning visar att aktier starka på insiderhandel statistiskt överpresterar mot marknaden.

OMXSPI är samlat sett tekniskt svagt negativt på medellång sikt (1-6 månader). Närheten till stöd- och motståndsnivåer gör att den tekniska bilden snabbt kan komma förändras. Vi rekommenderar långsiktiga investerare att alltid vara investerade på marknaden.

Published: Morning Report (Apr 1, 2025 08:19) [DO]

Lars-Göran Westerberg, Mar 23, 2025 (price 993.03)

Stockholmsbörsens breda OMSXPI-index avslutade veckan med att backa 1,4 procent under fredagen. Indexet utvecklas fortsatt inom en horisontell trendkanal. Fredagens nedgång gjorde att stödet vid 1000 punkter bröts vilket försvagar den tekniska bilden. En etablering på ovansidan 1000-1020 punkter och framförallt all-time-high vid 1058 punkter skulle stärka den tekniska bilden och utsikterna. På nedsidan finns stöd vid 966 punkter. Brott genom stöd- och motståndsnivåer ger signal om fortsatt kursutveckling.

Investtechs korta Hausseindex står idag i 37 på kort sikt. Indexet går mellan 0 och 100 och är en optimistindikator som visar andelen aktier på Stockholmsbörsen som haft köpsignal som sista signal. Ett värde mellan cirka 45-55 indikerar jämvikt mellan pessimister och optimister. På lång sikt står indexet i 47. Vi har därmed en övervikt av pessimister på kort sikt, medan det på lång sikt är jämvikt mellan pessimister och optimister.

Investtechs insiderbarometer visar antalet köp- och säljtransaktioner som har genomförts av insynspersoner i börsens bolag. Den senaste månaden har det registrerats 586 köp och 167 försäljningar, vilket motsvarar en köpandel på 78 procent. Köpandelen på årsbasis är också 78 procent. Investtechs forskning visar att aktier starka på insiderhandel statistiskt överpresterar mot marknaden.

OMXSPI är samlat sett tekniskt neutral på medellång sikt (1-6 månader). Närheten till stöd- och motståndsnivåer gör att den tekniska bilden snabbt kan komma förändras. Vi rekommenderar långsiktiga investerare att alltid vara investerade på marknaden.

Published: Morning Report (Mar 23, 2025 21:08) [LGW]

Analysts' recommendations last 18 months

| Evaluation | Time horizon | Price | Published | Analyst |

|---|---|---|---|---|

Weak Negative Weak Negative | Medium term | 954.44 | Apr 1, 2025 21:20, Morning Report | DO |

Weak Negative Weak Negative | Medium term | 945.21 | Apr 1, 2025 08:19, Morning Report | DO |

Neutral Neutral | Medium term | 993.03 | Mar 23, 2025 21:08, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 989.04 | Mar 11, 2025 21:30, Morning Report | DO |

Positive Positive | Medium term | 1 019.15 | Jan 24, 2025 08:58, Morning Report | LGW |

Neutral Neutral | Medium term | 983.52 | Dec 13, 2024 08:41, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 976.29 | Dec 3, 2024 08:07, Morning Report | DO |

Neutral Neutral | Medium term | 957.38 | Nov 16, 2024 20:03, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 1 008.65 | Oct 2, 2024 08:44, Morning Report | LGW |

Positive Positive | Medium term | 1 019.81 | Sep 27, 2024 00:54, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 984.56 | Sep 17, 2024 08:12, Morning Report | DO |

Neutral Neutral | Medium term | 960.51 | Sep 9, 2024 00:12, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 973.30 | Aug 15, 2024 23:08, Morning Report | DO |

Neutral Neutral | Medium term | 952.06 | Aug 4, 2024 22:23, Morning Report | DO |

Weak Positive Weak Positive | Medium term | 993.67 | Jul 24, 2024 22:01, Morning Report | LGW |

Positive Positive | Medium term | 1 002.24 | Jul 22, 2024 22:27, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 993.04 | Jul 19, 2024 23:12, Morning Report | LGW |

Positive Positive | Medium term | 1 012.72 | Jul 14, 2024 00:35, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 971.63 | Jun 14, 2024 23:51, Morning Report | LGW |

Positive Positive | Medium term | 974.31 | May 8, 2024 09:03, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 947.71 | Apr 12, 2024 00:41, Morning Report | LGW |

Positive Positive | Medium term | 897.93 | Feb 13, 2024 08:09, Morning Report | DO |

Weak Positive Weak Positive | Medium term | 882.38 | Feb 6, 2024 07:36, Morning Report | DO |

Positive Positive | Medium term | 892.01 | Feb 2, 2024 08:46, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 884.03 | Jan 4, 2024 08:25, Morning Report | LGW |

Positive Positive | Medium term | 889.11 | Dec 15, 2023 00:30, Morning Report | LGW |

Weak Positive Weak Positive | Medium term | 866.84 | Dec 13, 2023 08:57, Morning Report | LGW |

Positive Positive | Medium term | 871.53 | Dec 12, 2023 08:27, Morning Report | DO |

Weak Positive Weak Positive | Medium term | 828.70 | Nov 23, 2023 00:27, Morning Report | LGW |

Neutral Neutral | Medium term | 815.85 | Nov 15, 2023 08:55, Morning Report | LGW |

Weak Negative Weak Negative | Medium term | 783.58 | Nov 3, 2023 08:53, Morning Report | LGW |

Negative Negative | Medium term | 773.50 | Oct 20, 2023 08:40, Morning Report | LGW |

Weak Negative Weak Negative | Medium term | 803.24 | Sep 20, 2023 00:29, Morning Report | LGW |

DO: David Östblad (Analyst)

LGW: Lars-Göran Westerberg (Analyst)

Seasonal variations

Seasonal prediction from today's date

Monthly and annual statistics

Average development per month, last 10 years

Average development throughout the year, last 10 years

Annual development from 2015 to 2024

Early warning

Alerts

| Date | Price | Signal/Trading opportunity | Time span | Target |

|---|---|---|---|---|

| Mar 31, 2025 | 945.21 | Rectangle | Long term | 873.75 |

| Mar 31, 2025 | 945.21 | Rectangle | Medium term | 873.75 |

| Mar 31, 2025 | 945.21 | Long Term Trading Range | Medium term | -1.00 |

| Apr 2, 2025 | 945.47 | Supp broken, close to chart min | Short term | 915.00 - 925.00 |

Key ratios

Data missingHelp and information - Research shows the importance of Trend, Momentum and Volume

Investtech’s analyses focus on a stock’s trend status, short term momentum and volume development. These are central topics of technical analysis theory that describe changes in investor optimism or fluctuations in a company’s financial development. However, Investtech’s strong focus on these elements is due to research results that clearly indicate causation between these factors and future return on the stock market.

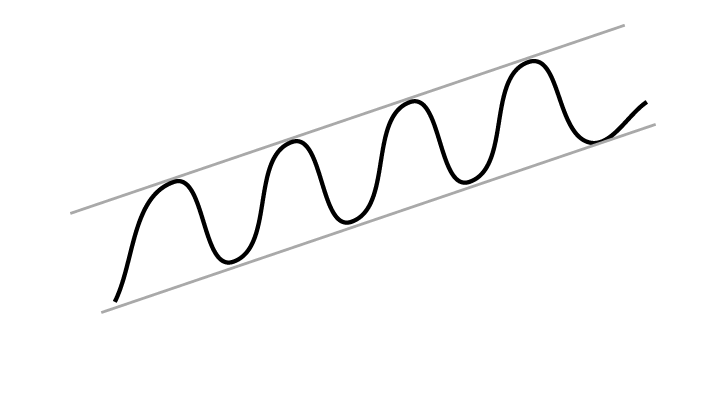

Trend

Theory: Stocks in rising trends will continue to rise.

Psychology/economy: Rising trends indicate that the company experiences positive development and increasing buy interest among investors. Read more

Research: Stocks in rising trend channels in Investtech’s medium long term charts have been followed by an annualized excess return of 7.8 percentage points compared to average benchmark development. This is shown by Investtech’s research into 34,880 cases of stocks in rising trends on the Nordic Stock Exchanges in the period 1996 to 2015.

Read more about the research results here

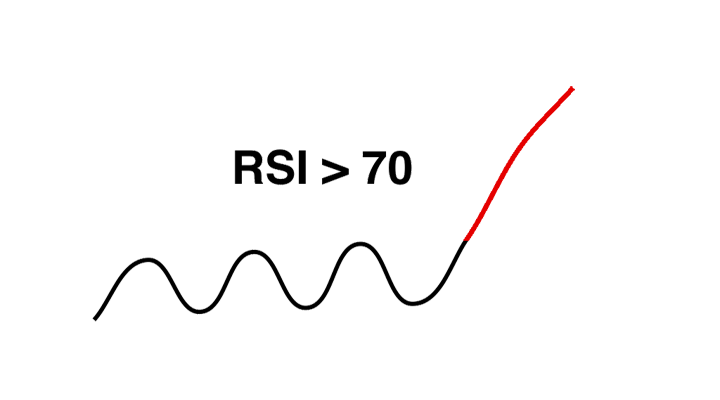

Momentum

Theory: Stocks with rising short term momentum will continue to rise. Stocks with very strong momentum (overbought) will react backwards.

Psychology/economy: RSI above 70 shows strong positive momentum. The stock has risen in the short term without any significant reactions downwards. Investors have kept paying more to buy stocks. This indicates that more investors want to buy the stock and that the price will continue to rise. Read more

Research: Stocks with strong momentum have on average continued to rise, and more so than the average stock listed on the Exchange. This is shown by Investtech’s research into 24,208 cases of stocks on the Nordic Stock Exchanges in the period 1996 to 2015 where RSI went above 70 points, indicating strong and increasing short term momentum. On average, annualized, the stocks rose the equivalent of 11.4 percentage points more than the average stock.

Read the research report here

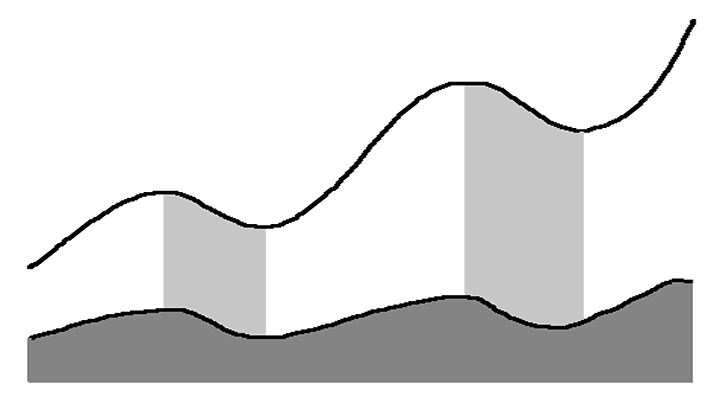

Volume

Theory: Rising prices on high volume and falling prices on low volume indicate strength in a stock. Volume can confirm a rising trend or signal that a falling trend is ending.

Psychology/economy: When investors very much want to buy a stock, they have to increase the price to find new sellers. Rising price on high volume shows that some investors are so aggressive that they push the price up to be able to buy the stock. Investtech’s Volume Balance tool measures the relation between price rise and volume and measures investor aggression at rising and falling prices. Read more

Research: Stocks with volume balance above 40 have been followed by an average annual return of 4.7 percentage points on the Nordic Stock Exchanges, shown by research conducted by Investtech into 24,580 cases.

Read the research report here

Investtech's analyses

Investtech has combined theory, psychology and research into powerful investment tools.

About Investtech

Investtech are behavioural finance and quantitative stock analysis specialists. The company sells analysis products to private, professional and institutional investors. Investtech manage the AIFM company Investtech Invest, which invests customers’ funds in the stock market.

Investtech’s computers analyze more than 28,000 stocks from 12 different countries every day. The analyses are presented in eight languages and sold to customers worldwide. In addition to the automatic analyses, the company’s analysts present subjective assessments and recommendations for some markets. The analyses are available to customers in the form of daily morning reports and cases, and weekly market updates and model portfolios.

Investtech’s algorithms for analysis, ranking and stock recommendations are based on research dating back to 1993. Part of the research was conducted in cooperation with Oslo University and the Norwegian Research Council. Research still has high priority for Investtech. Many of the company’s research results are available for customers on the company’s web site.

The company’s basic product starts at approx. 30 euro per month. Investtech also provides bespoke products for integration on partners’ web sites and for use in newsletters, for example to stock brokers and the media. Contact us by e-mail to info@investtech.com or by phone +47 21 555 888 for more information. A free trial subscription is available to order on our web site www.investtech.com.

Head Office

Investtech ASStrandveien 17

1366 Lysaker

+47 21 555 888

Postal address

Investtech ASStrandveien 17

1366 Lysaker

info@investtech.com

VAT no. 978 655 424 MVA

Research Department

Instituttveien 102007 Kjeller

www.investtech.com

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices